Important Bull Market Results

Overall performance rank for up/down breakouts (1 is best): not ranked

Break even failure rate for up/down breakouts: 11%; 16%

Average rise/decline: 31%; 14%

Throwback/pullback rate: 32%, 13%

Percentage meeting price target for up/down breakouts: 42%, 12%

The above results are preliminary, based on a sample of 202 qualifying

patterns (151 with upward breakouts, 51

with downward breakouts). The percentage meeting price target for down breakouts

showed that just 6 hit the target and the

pullback rate used just 26 samples. The numbers are likely to change.

Identification Guidelines

|

Characteristic |

Discussion |

|

Price trend |

Can be any direction leading

to the pattern. Best performance comes from patterns with price trending upward leading to the pattern. |

|

Shape |

A big W shape with twin bottoms

and tall sides. |

|

Reversal pattern |

Look for a double bottom reversal

pattern at the base of the big W. |

|

Tall sides |

The best performing big W chart patterns have tall,

straight declines leading to the bottom of the big W. |

|

Left side decline |

The decline leading to the

first bottom should be at least 1.5 times the rise between the two bottoms for best performance. |

|

Double bottom |

The double bottom should have

twin bottoms with lows less than 4% apart. |

|

Rise between bottoms |

The rise between the valleys

of the double bottom is 10% to 20% or more. |

|

Volume |

Recedes 60% to 63% of the

time for up/down breakouts respectively. |

|

Breakout |

Look for an upward breakout.

That’s when price rises above the right side of the big W. |

|

Confirmation |

The pattern confirms as a

valid one when price closes above the highest peak between the double bottoms. |

Trading Tips

|

Trading Tactic |

Explanation |

|

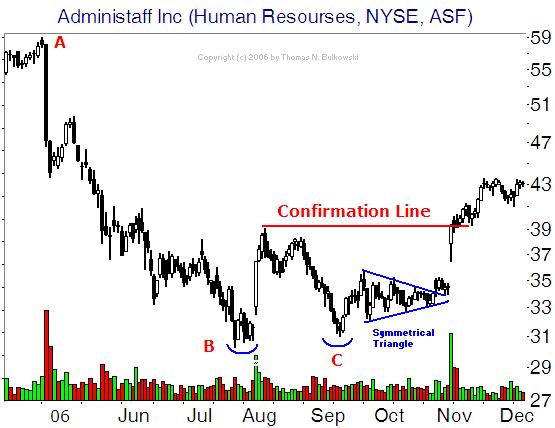

Measure rule |

Compute the height from the highest peak (usually the left

side of the big W, point A in this example) to the

lowest valley (B) and then multiply it by the above

“percentage meeting price target.” Add the result to the right side of

the big W (upward breakouts, C) or subtract it from

the lowest valley (downward breakouts, B).

The result is the target price. The link to the left gives more information about

the measure rule. |

|

Breakout |

Upward breakouts occur when price closes above the right

side of the big W (C). Downward breakouts occur when

price closes below the lowest valley in the big W (B).

|

|

Stall |

For swing traders, buy at the double bottom low (E) and ride

price upward to confirmation of the double bottom (the high between the two

bottoms, D). Price often pauses there. If price drops

below the low of the second bottom (E), exit the

position immediately. If price confirms the double bottom, expect a rise

approaching the left side high (A).

|

|

Position traders |

Wait for confirmation of the double

bottom before taking a position and be prepared to sell as the stock nears the

price of the left side high (the price at C approaches

the price at A). |

|

Left side high |

The right side high of the big W (C) reaches the price at the start of the pattern (A) 46% of the time. |

|