|

Trading Strategy:

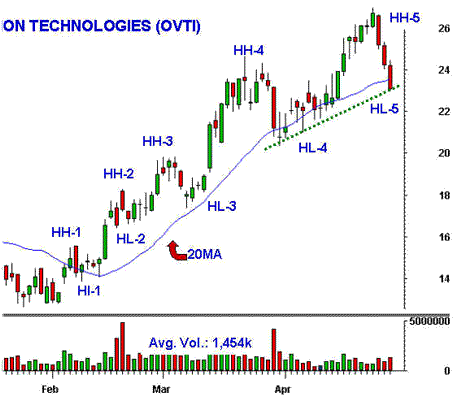

Buy Setup on trend line and minor

support. OVTI was in a powerful Stage 2

on the daily chart, as shown by the series of

higher highs (HH) and higher lows (HL). It has

sold off for three days, back to an area of

minor support from the prior consolidation.

Because of the deep retracement, one should not

be looking for a new high right away, but a

tradable bounce nevertheless. It is also

considered to be a GuerrillaTM

Bullish Setup because it was down at least two

days, and previous day’s bar is a Bearish 20/20

bar (wide range bar with little tails). It

closed at the low, on prior support. This also

happens to correspond with trend line support,

as shown on the chart.

chart courtesy of

Mastertrader.com

Tip: A BS on trend line

and horizontal support, that is also a GuerrillaTM

Long Setup, is a more powerful combination

suggesting a tradable bounce once the bulls

regain control of the stock.

The Play:

Buy over the high made during the first 30

minutes of trading (as the previous day's high

is too far away), with a protective stop under

the lower of the day’s low or yesterday’s low.

[NOTE: Because of the Long GuerrillaTM

Setup, the Trading Strategy is valid for two

trading days.]

Objective:

A move to the $25.00 area.

MEDIUM RISK

Play Review:

OVTI reached a high of $28.50

after five up days. Best results were achieved

using trailing stops.

|