|

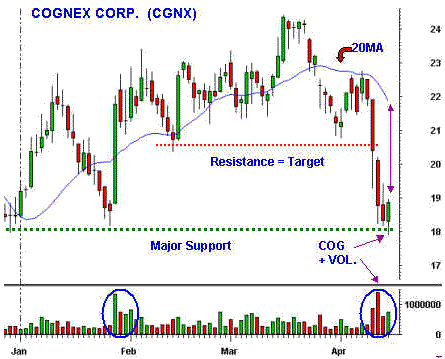

Trading Strategy:

Buy Setup at prior low on

increased volume. CGNX closed the previous week

very oversold, near its low. Volume picked up in

the area of the prior low set late January,

before it exploded up on a bullish wide range

bar. It also overshot its 200MA, which is

watched by many traders as an area of support.

Previous day it made a bullish Changing of the

Guard (+COG), and also had a bottoming tail,

showing that the bulls have taken back control

of the stock for a bounce.

chart courtesy of

Mastertrader.com

Tip: Stocks that close

strong after retesting a prior major low on

increased volume are poised for a tradable

bounce.

The Play:

Buy once it trades over previous day high

($18.95). Stop above $18.29 (close of two days

ago - open of the previous day). Move stop break

even once $.50 in-the-money.

Objective:

A move to the $21.00 area.

MEDIUM RISK

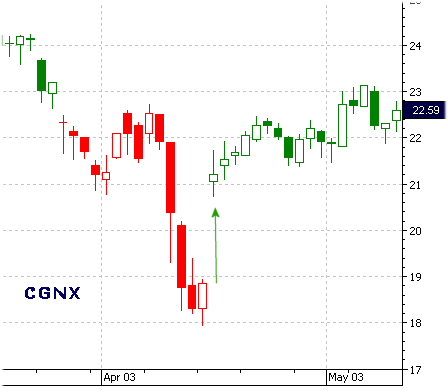

Play Review:

CGNX did not trigger because

of the excessive gap caused by positive

earnings. If the gap was less than 50 cents, it

would have still been considered as entry within

play limits. |